Understanding House Flipping

What Exactly is House Flipping?

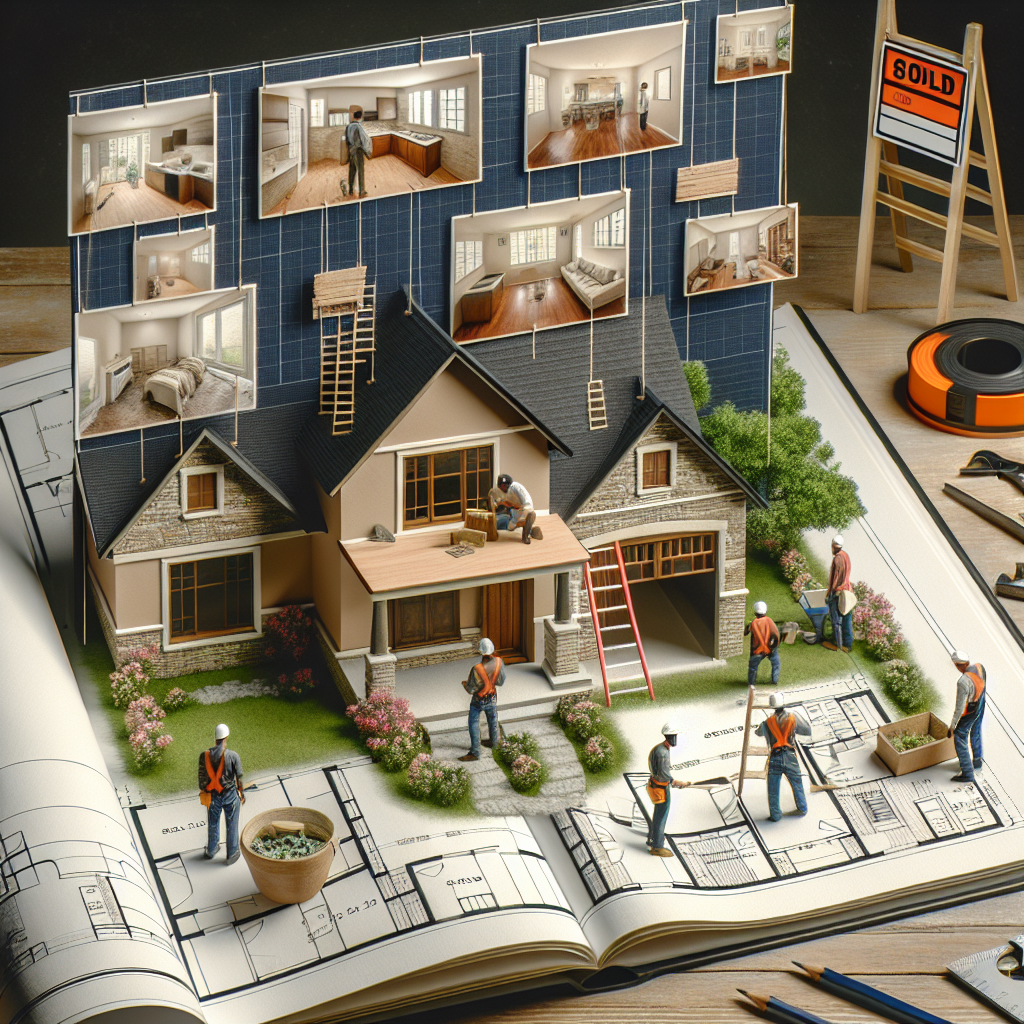

House flipping is basically buying a property, sprucing it up, and then selling it for a profit. Sounds easy, right? Yeah, but there’s a lot more to it than just slapping some paint on the walls and calling it a day. It involves a keen understanding of real estate markets, renovation processes, and, most importantly, a good measure of risk management.

This whole concept of flipping houses has been around for quite some time, but it has gained serious popularity thanks to shows on TV that glamorize the process. It looks fun, adventurous, and profitable on screen, but the reality can be quite different. It takes knowledge, planning, and a bit of grit.

Plus, you really need to understand your budget and timeline. Miscalculating either one can push you into the red rather than the green, and that’s definitely not how I roll!

Why Flip Houses?

For me, the thrill of flipping houses isn’t just about making quick cash. It’s about transforming something neglected into a shining gem. I’ve always had a knack for seeing potential in properties. When I step into a rundown house, my mind starts racing with ideas on how to make it beautiful again.

Additionally, flipping houses can be a great way to build wealth. If you do it smartly, the returns can be substantial. This isn’t just about slumps in the market; even in downturns, I’ve found that well-renovated homes still manage to attract buyers.

But let’s be honest—house flipping isn’t for the faint-hearted. It’s a gamble, and you’ve got to be prepared for both wins and losses. Make sure you weigh the options before diving headfirst into a project!

Market Research Essentials

Before I jump into a flip, I always conduct thorough research. You can’t just pick any property and hope for the best. Understanding the market is crucial. I look at neighborhood trends, property values, and even the type of buyers who are moving into the area.

Another component of market research is identifying the right time to buy. For instance, there are certain seasons that are more favorable for buying and selling properties. If you plan to flip, timing can make or break your profit margins.

Lastly, I tap into resources like local real estate agents. They have invaluable insights and data that can help guide my decision-making process. Working together with them has saved me countless headaches and helped me find some excellent deals!

Finding the Right Property

Tips for Property Hunting

Finding the perfect property is like hunting for treasure! I usually start my search online, but honestly, some of my best finds have come from driving around neighborhoods and looking for neglected homes. You can often score a great deal through connections, too—word of mouth can be golden.

Online platforms such as Zillow or Redfin are great tools to filter through listings based on my specific needs. I usually set alerts for properties that meet my criteria. You never know when a good deal might pop up!

Once I spot something that seems like a good potential flip, I make sure to do a drive-by. You can get a good feel for the neighborhood and the kind of people who live there, which is crucial for determining resale value later on.

What to Look For

When I’m looking for a house to flip, I focus on properties that need cosmetic improvements rather than major structural repairs. I can handle some paint, flooring, and minor renovations, but if the roof is sagging or the foundation is cracked, it’s best to steer clear.

Additionally, I look for properties in neighborhoods that are up-and-coming. These areas often provide better profit margins as they are on the brink of growth. The right location can significantly increase a flipped property’s value.

And let’s face it, I also look for properties where I can add value. If there’s room for expansion or new bathrooms can be added, that’s a huge plus! Always keep an eye out for hidden gems!

Analyzing Costs

Once I’ve found a property, the next step is analyzing its costs. This involves calculating the purchase price as well as the projected renovations. I usually create a spreadsheet to help outline these costs, keeping a running tally of everything.

On top of the renovation costs, I always remember to factor in other expenses—like taxes, insurance, and potential holding costs. These can sneak up on you and impact your budget significantly.

Finally, I make a plan for financing the purchase. Some folks use cash, while others rely on loans. Depending on your situation, there may even be affordable options out there, so do your homework before committing!

Renovation Strategies for Success

Planning Your Renovation

A solid plan is everything when it comes to renovations. I always start with a detailed checklist of what needs to be done. This helps keep me on track and avoid getting sidetracked by less important issues.

I like to prioritize the work that will give me the best return on investment—kitchens and bathrooms usually top that list. Investing in key areas will maximize the appeal for potential buyers later on.

It’s also critical to have a timeline. I set deadlines and do my best to stick to them. Renovations can take longer than expected, so being flexible is important, but I try to maintain my schedule as much as possible!

https://Credit411USA.com

Choosing the Right Contractors

If I’m not doing the renovations myself, hiring the right contractors is super important. I always take the time to vet potential contractors. Reviews, referrals, and previous work are key indicators of who can do a quality job.

It’s also a good idea to get multiple quotes. I don’t want to overspend on any renovation work. Getting different perspectives helps me decide who offers the best value while still assuring quality work.

I maintain open communication throughout the renovation process. This way, any surprises can be dealt with promptly without turning into a major headache. Trust me; it pays off in the end to keep the lines open!

Marketing the Flipped Property

Now that the renovations are done, it’s time to put on my marketing hat. I typically stage the home to help potential buyers envision living there. Staging can significantly impact the final sale price and speed of sale.

Next, I think about how to market the property. Listing online is a must. Professional photos can make a huge difference, too. I always hire a photographer to capture the home in the best light—it really does pay off!

Lastly, I consider open houses to showcase the property. This allows potential buyers to get a feel for the space and have a direct connection with me or my real estate agent, which can seal the deal!

Finalizing the Sale

Navigating Offers

When I start receiving offers, I remind myself to be patient. Not every offer is what it seems. I always review the offer terms, not just the price. Sometimes a lower offer with favorable conditions can be more enticing in the long run.

Negotiation is key here. I always leave room for negotiation while maintaining my expectations. After all, I want to make the most out of my investment!

Don’t forget to consider the buyer’s position and their ability to close the deal quickly. A cash buyer is often more attractive than someone relying on financing—these things can save you from a lot of headaches.

Closing the Deal

Once I’ve accepted an offer, the closing process begins. This usually involves a lot of paperwork and can be a bit tedious. I always stay organized and keep track of my documents to ensure everything goes smoothly.

It’s good practice to be present for inspections and appraisals. I find communication to be vital during this stage to make sure everything stays on track. I usually coordinate with my agent to make sure we’re on the same page.

Finally, once the closing is complete, it’s time to celebrate! Closing a flipped home is a fantastic achievement, marking the successful conclusion of all the hard work. I take a moment to appreciate what I’ve accomplished.

Reflecting on the Experience

After a flip, I always take the time to reflect on what I learned throughout the process. Each property has its own set of challenges, and I’ve gained piles of experience with each one. I document what worked and what didn’t, which helps improve my future projects.

Networking is another critical takeaway. During my flips, I’ve met countless people—contractors, agents, and fellow investors—and these relationships can help future endeavors and lead to more opportunities down the line.

Ultimately, every flip is a unique journey. By embracing these nuances, I can refine my approach and grow as an investor. Plus, it keeps things exciting, which is exactly how I like to roll!

FAQs

1. What is the average time it takes to flip a house?

The average time can vary quite a bit, but typically it can take anywhere from a few months to a year, depending on the renovations needed, market conditions, and your ability to manage the project effectively.

2. Can I flip houses without prior experience?

While having experience helps a lot, many people start flipping houses without any prior knowledge. It’s crucial to educate yourself through courses, books, and by connecting with experienced flippers to learn the ropes.

3. What are the risks involved in house flipping?

Flipping houses carries various risks such as market downturns, renovation delays, unforeseen expenses, and the potential inability to sell the property at a profit. It’s essential to do your homework to mitigate these risks effectively.

4. How much money do I need to start flipping houses?

The amount needed can vary widely based on the market and the property. Generally, having at least 20% of the purchase price for a down payment, plus reserves for renovations and holding costs, is a good starting point.

5. Is it necessary to hire real estate agents or contractors?

While it’s not strictly necessary, hiring professionals can save you time and money in the long run. A knowledgeable real estate agent can help you find good deals, while experienced contractors know how to get the job done right, potentially avoiding costly mistakes.

https://Credit411USA.com